Once you’ve made it,

A good legacy plan allows you to take what you’ve build and find the best ways to channel it toward your retirement, philanthropic and family goals. Our offering is designed to address all the financial challenges of transitioning from the wealth-building phase to the legacy-building phase.

We provide transition

and legacy planning

services that include:

- Defining the structures, valuation and exit strategies for transitioning your business

- Strategies for planning your retirement or semi-retirement

- Investment planning with risk management and preservation tactics

- Advanced tax strategies for extracting capital, charitable giving and transferring wealth

- Planning your estate and passing your wealth to the next generation

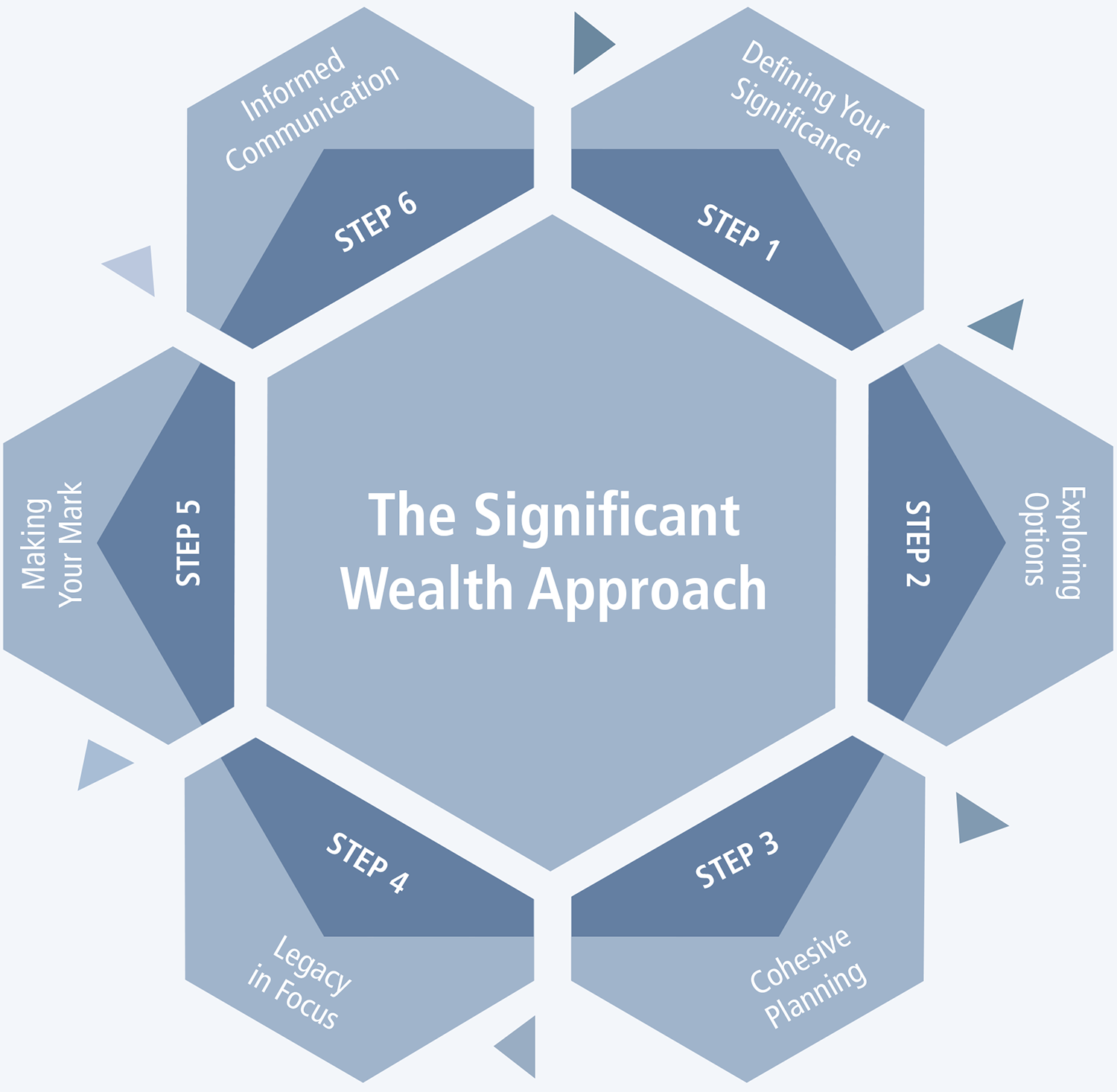

THE SIGNIFICANT WEALTH APPROACH

It takes a process to uncover significance of what you’ve built and the legacy you want to leave. After working with countless business owners, retirees and professionals over the course of 30+ years, we’ve developed a disciplined approach to help our clients do just that.

- STEP 1 DEFINING YOUR SIGNIFICANCE

We start by examining your accumulated wealth and defining the legacy that you hope to achieve. - STEP 2 EXPLORING OPTIONS

After gathering options for each aspect of your plan, we communicate them in clear terms. - STEP 3 COHESIVE PLANNING

We bring the best options together in a comprehensive plan that incorporates your accountant and other professionals. - STEP 4 LEGACY IN FOCUS

We present your plan to you and walk you through the steps involved in creating the legacy you have defined. - STEP 5 MAKING YOUR MARK

We ensure all aspects of the plan are implemented effectively. - STEP 6 INFORMED COMMUNICATION

While monitoring and reviewing your plan, we keep multiple lines of communication open to ensure you stay informed.