Retirement really means freedom earned through a lifetime of achievement — and if there’s anything that your financial strategy should help you do, it’s to be able to enjoy this freedom as much as possible.

Partnering with the best retirement financial advisors ensures a smooth and stress-free transition into retirement. Our retirement planning specialists focus on your financial freedom by crafting personalized, goal-oriented strategies.

To this end, we work to

define a comprehensive

retirement wealth

strategy that includes:

- A retirement plan designed and balanced according to your personal needs and priorities

- Evaluating and clarifying your options through the 4-Part Retirement Framework

- Your custom investment portfolio and unbiased investment advice

- Your retirement projections with goal and cash flow breakdowns

- Advanced tax strategies for transitioning into retirement and preserving wealth

- Ongoing education and one-to-one guidance Our retirement planning specialists help you enjoy this exciting chapter with a clear plan and a personal touch.

Claim Your FREE Gift!

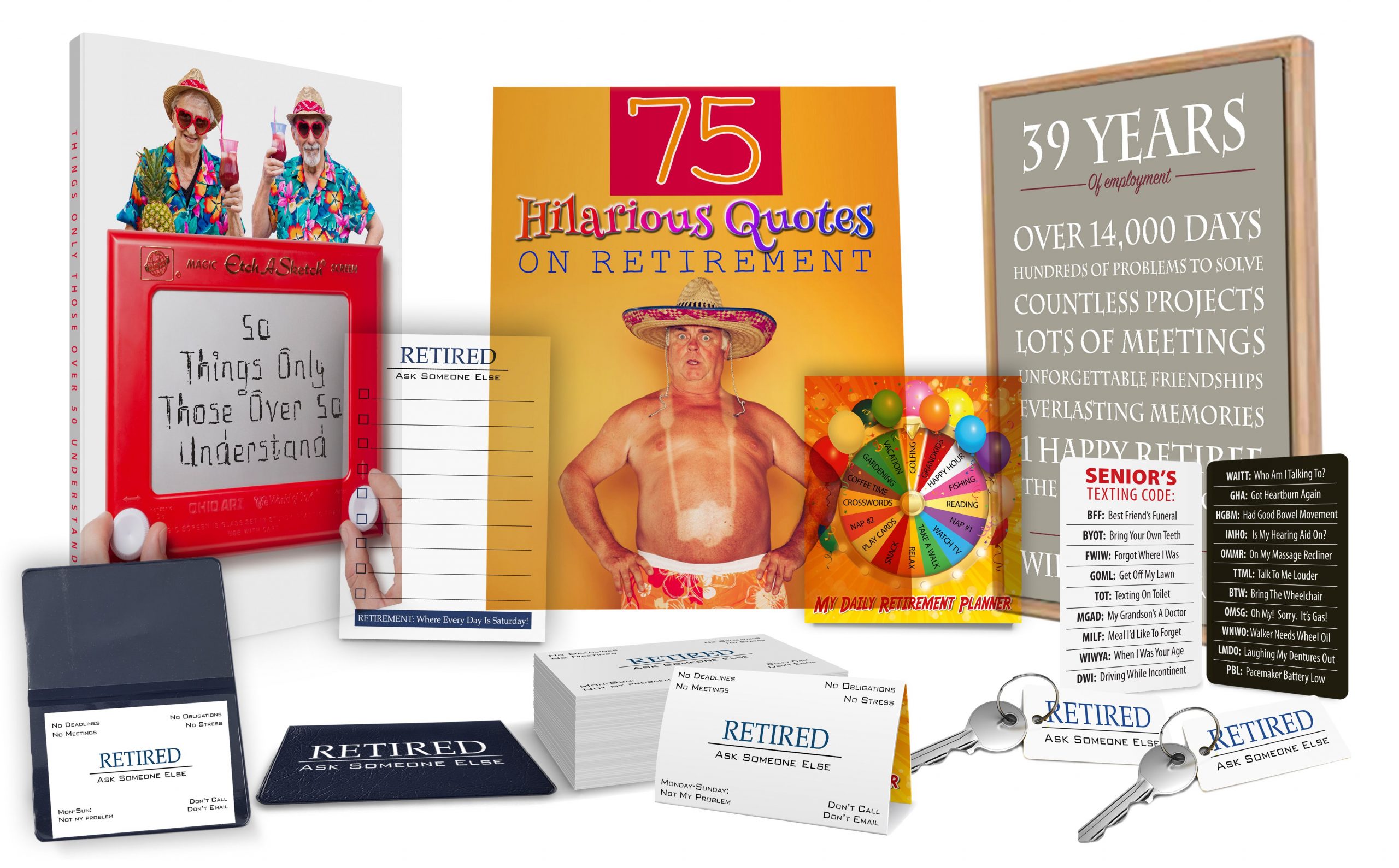

If you were born in 1955 and turning 65 in 2020 this is a very Special Gift I think you’ll find as hilarious as I did.

Just enter your name and the address where you would like it sent, and it will be on its way. Enjoy my hilarious gift to you and be sure to let me know how you like it.

Here is what the hilarious gift includes:

50 RETIRED Business Cards

1 RETIRED Business Card Wallet

1 RETIRED To Do List Notepad

1 Personalized Retirement Celebration Poster

(suitable for framing)

1 RETIRED Senior Texting Code Card

(to keep in your wallet or purse)

2 RETIRED Key Tags

(for your key ring)

2 eBooks

75 Hilarious Quotes On Retirement

50 Things Only Those Over 50 Understand

As one of the best retirement financial advisors, we celebrate your retirement with meaningful gifts and expert guidance. Let’s make this one as rewarding as possible.

The 4-Part Retirement Framework

Putting everything in place for retirement becomes much simpler if you can define a few key pieces. The 4-Part Framework is our retirement planning specialists’ proven method to simplify your retirement journey. With a focus on your future, our expertise as retirement financial advisors ensures your plan balances growth, stability, and flexibility.

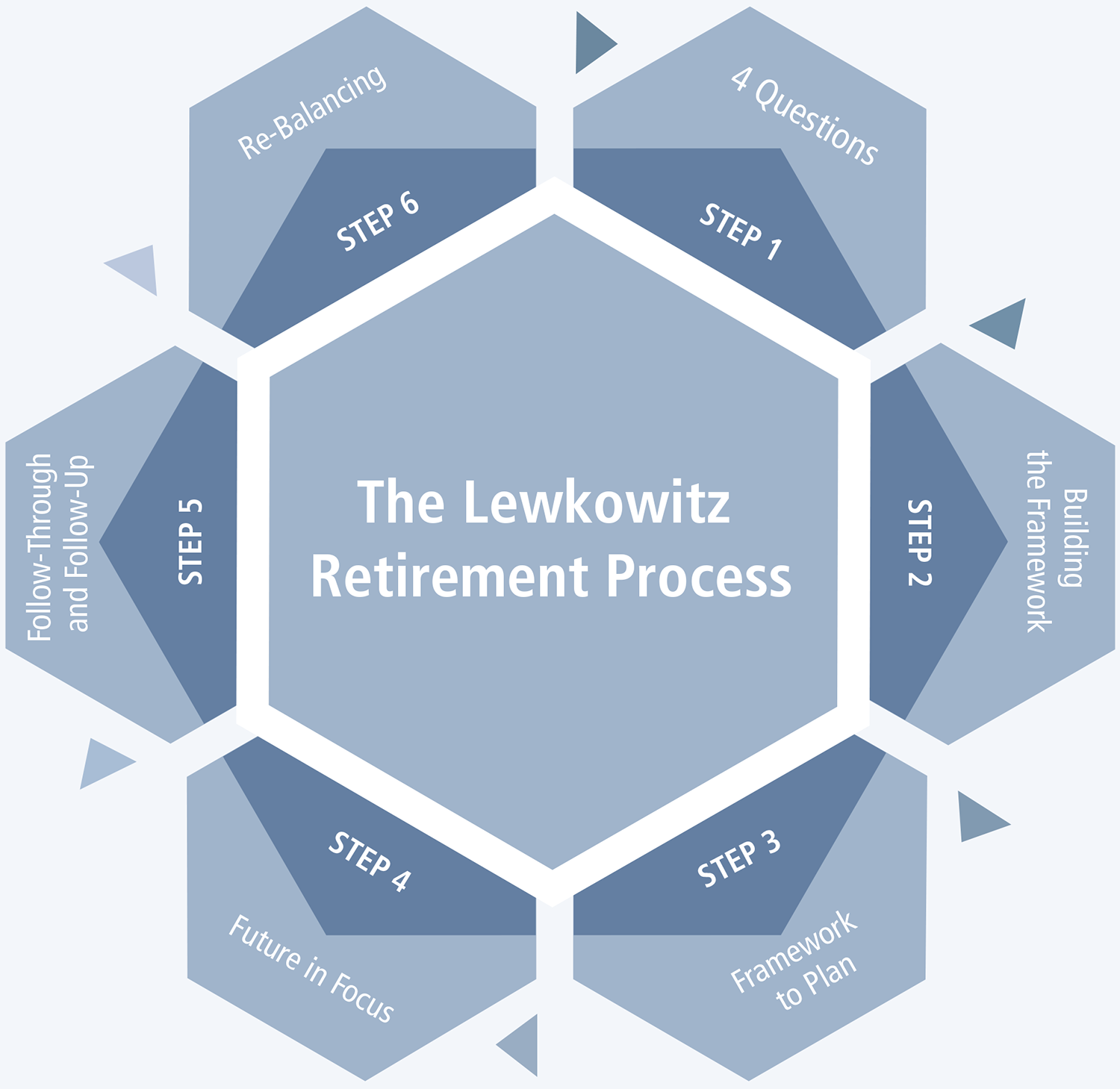

THE LEWKOWITZ RETIREMENT PROCESS

We begin the planning process by answering these four questions, so that we can narrow down the myriad of options in front of you and start building a clear strategy.

The best retirement financial advisors create strategies that turn retirement goals into reality. Our proven process simplifies decisions so you can feel confident about achieving financial security.

- STEP 1 4 QUESTIONS

We start by examining your wealth and defining your retirement goals in the context of our 4 essential variables. - STEP 2 BUILDING THE FRAMEWORK

We explore the options available to produce the savings and growth you need to reach your goals. - STEP 3 FRAMEWORK TO PLAN

We bring the best options together into a comprehensive plan that balances the 4 retirement variables. - STEP 4 FUTURE IN FOCUS

We present your retirement plan and walk you through the steps it involves. - STEP 5 FOLLOW-THROUGH AND FOLLOW-UP

We ensure all aspects of your plan are implemented effectively. - STEP 6 RE-BALANCING

Our ongoing communication involves reviewing your plan and ensuring the 4 variables remain balanced according to your needs. Your trusted retirement financial advisor is here for ongoing support, adapting your plan as life changes to keep your goals on track.